Thomas Carlyle coined this epithet in 1839 while criticising Malthus, who warned of what subsequently happened, exploding population.

According to Carlyle his economic theories: "are indeed sufficiently mournful. Dreary, stolid, dismal, without hope for this world or the next" and in 1894 he described economics as: 'quite abject and distressing... dismal science... led by the sacred cause of Black Emancipation.' The label has stuck ever since.

This 'dismal' reputation has not been helped by repeated economic recessions and a Great Depression, together with continuously erroneous forecasts and contradictory solutions fuelled by opposing theories.

This article reviews some of those competing paradigms and their effect on the economic progress of Australia.

In Australia economic thought took a couple of U-turns last century

For its first one hundred and seventy years the economy of New South Wales (and then Australia as a whole after 1901) was extraordinarily vulnerable to climate and agricultural trade cycles.

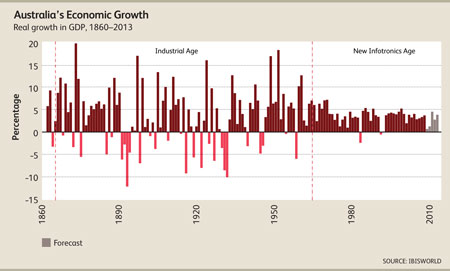

Phil Ruthven IBIS: ‘The chart shows Australia’s economic progress over 140 years... ‘The volatility was enormous both before and during the Industrial Age (1865-1964) largely due to weather. Agriculture remained over 15% of our GDP for most of that period… ‘a 25% fall or more in output would slice 4% off the economy by itself - with a domino effect through the food & fibre input-output chain - causing a recession. We had 27 such years or one every 3-4 years...

During the 20th century Australian governments experimented with the full spectrum of government interventions to develop manufacturing; both to reduce our dependency on agriculture and to increase Australia’s military resilience. To grow and protect manufacturing Australia applied, then abandoned: selective tariffs; publicly owned businesses; and enforced government purchasing preferences.

Until the start of the 20thcentury the political differences in pre-federation Australia were polarised around the issue of ‘free trade’ verses protection (NSW versus Victoria).

The electoral success of the Australian Labor Party (in 1910) (following the Marxist social analysis in the mid 19thcentury, and English Fabianism) led to a new polarisation around worker’s rights and the socialist alternative to capitalism; retaining a strong protectionist sentiment. With the split in the Labor party, at the start of the ‘Great Depression’, a new ‘United Australia Party’ (in government from 1932 to 1941) formed around ex Labor Treasurer Lyons and Labor splinter groups, together with the older establishment dominated parties (both free traders and protectionists).

Thus by the middle of the century, both major parties had elements combining the older protectionist movements, as well as elements supporting socialism and public ownership. Protection and government owned enterprise became an accepted reality on both sides of politics, reinforced by industrial mobilisation during two world wars.

By the mid 1960’s, under the protection of import tariffs and direct government involvement in economic production, manufacturing in Australia had grown to become the largest and most productive sector in the economy, long supplanting agriculture, services and mining.

But as the Menzies/ McEwen era drew to an end in the late 1960’s it was already apparent that much of this manufacturing and government enterprise was inefficient and unable to compete internationally. Within the new Universities, post-war academic sentiment was swinging towards Neo-Keynesian (eg Samuelson) or Monetarist (eg Friedman) economics together with a strong belief that freer markets would deliver greater economic efficiency and administrative simplicity. The intellectual climate had changed.

Free trade and free market arguments prevailed, in both major political parties, and the progressive withdrawal of protection followed, along with the disposal of government owned businesses and local buying requirements.

A post-modern economic paradigm

It is now a generally accepted tenant of economics that selective protection (applying to a single industry sector or business) is economically distorting and results in sub-optimal economic performance, a poor allocation of productive resources and a distorted distribution of wealth.

A universally applied import tariff (not selectively applied) on the other hand, is economically equivalent to (and can be achieved by) a downward revaluation of the currency, lowering the price (and value) of exports and raising the price of imports (and lowering their competitiveness). The effect of either is to make local manufacturing more profitable, with less pressure to be competitive.

But the purpose of trade is to maximise its benefit to the wealth of the country and its citizens. In the immediate present this is achieved by getting imports a cheap as possible and selling exports for the highest price available. Both tariffs and an artificially low currency sacrifice this present wealth for some hoped for future gain.

In 1967the first minerals boom and a large increase in foreign investment lead to the dollar’s decoupling (un-pegging) from the pound sterling. Its strong upward revaluation followed. Together with the Federal Government’s determination to dismantle protection, this contributed to rapid economic restructuring.

These changes saw a long decline in relative importance of manufacturing, both as an employer and as contributor to total value added (GDP). This impact was felt first in NSW, the largest and then the most industrialised State. The impact was later, but perhaps more severe, in Victoria and SA, where remnants of protection continued for textiles clothing and footwear (TCF), the automotive industry and some special cases (like Kodak) until recently.

In Australia, throughout this period of manufacturing decline, there was an ongoing debate as to the wisdom and prudence of ‘living in the present’ with no concern for the probable future; where, it was believed, the capability to make things might be necessary, particularly in the context of national defence. There was also a lingering cultural belief that Australia needed to ‘populate or perish’; that it was necessary (or feasible) to out-populate our expected enemies; those jealous of our ‘abundant wealth’. Labour-intensive manufacturing was promoted an essential part of this imperative; as at that time a significant number of manufacturing locations still employed thousands of people; and the TCF industry was a very large employer of immigrant women.

Another stream of concern was that ‘infant’, particularly ‘hi tech’ industries needed initial support to become established (after which assistance might be wound back); and latterly that certain industries (like automotive manufacturing) are essential to preserving a reservoir of industrial skills and capabilities.

Against this it was argued that governments are not skilled (and have a very poor track record) at ‘picking future winners’ and are likely to protect industries (and thus enrich some people at the expense of the rest) that have no long term commercial merit (like steam train, typewriter, radio valve or large scale vinyl record manufacture); that such commercial risk is best taken by those who may reap the rewards of success (or suffer by their failure); and that interventions by government ‘socialise risk and privatise profit’.

The strong dollar was said to be ephemeral and to exploit the value of finite natural resources that were being depleted (the Dutch disease) to maintain the buying power of an ever growing consumer market, fed by high levels of immigration.

That the value of the dollar is supported by the exploitation of non-renewable resources, and that this will end in disaster, is a similar argument to that on climate change: 'we are presently exploiting the wealth of future generations and leaving them with a depleted environment'. Against this, technological progress makes it very difficult to predict what resources the future may or may not need or find valuable. Banks and Phillip believed the potential wealth of New South Wales to be in flax and pines (for sails and masts). They would have seen no value in a nickel or tantalum deposit or even in iron deposits ‘on the other side of the world’.

In an environment of enormous change (and seemingly random natural disasters and fluctuations) are voters ready to make sacrifices to their living standards now in the interests of speculative outcomes in the medium to distant future? Recent reactions to the proposed higher mining tax and to the prospective carbon pollution reduction scheme suggest not.

It has been argued that various countries (that would become future competitors) accelerated economic development through the deliberate application of economically distorting economic tools (direct intervention in the productive process) aimed at directing productive resources towards selected industrial activity, education and research; combined with currency manipulation to lower the price of exports; increase domestic savings; and increase investment overseas. This was seen to be particularly effective in Japan, Korea and China in moving from predominantly rural, feudal societies to industrial ones.

In 1975 the ‘Jackson Green Paper’: ‘Policies for Development of Manufacturing Industry’ (following the Industries Assistance Commission annual report of the previous year) predicted that the industries most likely to be encouraged by the change from protection to free trade would include:

-

The Service Sector.

-

Manufacturing industry that is land (eg food) or minerals based.

-

Manufacturing industries based on skill, innovation or design.

-

Industries with a high degree of natural protection by virtue of their bulk, non-durable nature or ability to satisfy specialised local demands.

-

Rural industries – particularly exporters.

-

Mining industries based on rich deposits.

A prominent and influential member of the ‘Jackson Committee’ was Robert JL (Bob) Hawke – future Prime Minister.

By 1983 political intervention in the relative value of the dollar, partly driven by electoral considerations, had led to growing disquiet about its negative impact on economic restructuring and the dollar was floated (by the Hawke/Keating Government).

Into the 21st century

With the exception of one or two dissident voices, on both sides of politics, there is now bipartisan support for free trade and free enterprise. Australia is now one of the World’s principal advocates of free trade and argues that industries that are not internationally competitive are a burden on national (and collective) wealth. Most previously government owned trading organisations have been privatised. It is argued that international competition leads to improved efficiency, productivity and is an incentive to innovate.

As predicted by Jackson, Australia has moved to become a service economy and the largest industry sectors in NSW are now Retail trade, Property and business services, and Health and community services. Manufacturing is now on fourth position.

There is little doubt that Australia’s very strong economic growth performance and relative insulation from international economic downturns is an outcome of its ability to exploit the moment and extract the best available advantage.

It can also be argued that the last remnants of protection have now been stripped away and primary industry, manufacturing and the service sectors have reached a more or less stable base and share of the economy consisting of: “industry that is land (eg food) or minerals based; industries based on skill, innovation or design; and industries with a high degree of natural protection by virtue of their bulk, non-durable nature or ability to satisfy specialised local demands”.

But the non-mining good producing sectors like manufacturing are still at the mercy of declining protection. It can be seen from the earlier discussion that the value of the Australian dollar is now the single greatest determinant of manufacturing viability and growth (or decline) in Australia. In addition to the implicit protection afforded by a low dollar, and corresponding lack of protection afforded by a high dollar, rapid fluctuations in the value of the dollar and cost of capital militate against businesses that are highly capitalised and need a continuous, relatively stable return on that capital. These fluctuations both affect viability and make it difficult to predict return on investment.

External influences on the dollar’s value include money market speculation, the country’s trade performance and international investment flows. The principal visible trade drivers of a strong Australian dollar are our mineral and energy exports but agriculture, trade in services and manufacturing itself are important contributors.

The various Governments’ fiscal behaviour has an influence on internal distributions of wealth and on savings, in turn influencing investment, and the longer term dollar valuation.

The remaining (benign) facility to smooth fluctuations and influence the dollar’s value (through money market operations and interest rate manipulation) now rests with the independent Reserve Bank (established in 1960 under Menzies).

While government has substantially withdrawn from direct market manipulation and participation in support of manufacturing it continues to play a number of important roles that directly or indirectly support or influence manufacturing viability. These include:

-

regulations affecting export reputation (eg export meat and dairy);

-

regulation of occupational health and safety;

-

regulation of business practice, including accounting and competition;

-

regulation of emissions (airborne, water, noise);

-

local planning and zoning;

-

maintenance and expansion of transport infrastructure (roads, rail, ports, airports);

-

ensuring the appropriate availability of electricity, gas, water, and waste disposal;

-

ensuring an adequate information technology and communications infrastructure;

-

participating in international standards;

-

providing support for research and technology development;

-

providing export development services;

-

negotiating international trade agreements and partnerships;

-

providing and/or supporting basic, trade and advanced education;

-

ensuring a healthy population; and

-

maintaining law and order and the protection of property.

As identified by Jackson, manufacturing can be divided into processing industry that is land (eg food) or minerals based; industries with a high degree of natural protection by virtue of their bulk, non-durable nature or ability to satisfy specialised local demands; and industries based on skill, innovation or design, in other words those possessing unique intellectual property.

Strong areas of manufacturing export, based on indigenous resources, include semi-processed mineral and energy resources such as alumina, basic metals and aviation fuel; and a wide range of processed rural products including wine, processed milk, meat, sugar and processed fruit. Indeed, processed food exports significantly exceed the value of unprocessed food exports.

Manufacturers that are not trade exposed due to the bulk of their product, its non-durable nature, or their ability to satisfy specialised local demands, include: cabinet making (eg kitchens); bread making; and steel fabrication. These compete with other local firms; with substitute products; and from the risk that there will be new local entrants if their productivity is too low or profit taking is too high.

A small and decreasing subset of this group is protected by non-tariff barriers such as uniquely Australian standards and/or regulations. These are more common in primary industry but a traditional manufacturing example was electrical appliance cords. A number of other electrical, railway and telecommunications components and were similarly ‘protected by regulation’. Australian standards are now harmonised with several overseas (European and US) standards and it is notable that many of these, once protected, items are now imported.

The technology used by these firms is often simply imported and there is less pressure to be highly innovative or better managed. Increased competitive pressure and the potential for imports to supplant their products will generally result in a net economic gain.

The remaining, trade exposed, manufacturers rely heavily on skill, innovation and/or design (intellectual property – IP). In many cases this competitive advantage stems from a novel appreciation of a market opportunity together with knowledge of a recent technological advance that presents a solution. This often depends on a good understanding of the ‘state of the art’ and an ability to mobilise resources and materials processes and/or techniques from a wide variety of sources.

These businesses often use imported materials or components and benefit from improved trade access, lower trade barriers and declining international transportation costs. It has been estimated that around 92% of innovative technologies and a similar proportion of the apparatus and equipment used in Australia are sourced from overseas.

IP dependent business is a volatile sector where most new manufacturing jobs are generated but where company formation and failure (churn) is also high.

It is paramount that innovative businesses ‘stay ahead of the game’; have ready access to world knowledge and skills; and are able to freely or competitively acquire knowledge, techniques and equipment.

This is the group upon which most (past and present) government industry assistance and information programs are focused.

Why don't governments get involved?

Governments would like to advance local transformative industries for several reasons:

- In general, manufacturing jobs involve higher skill levels than those in many of the service sectors and attract correspondingly higher remuneration. Higher value added per employee has general economic benefits including a higher general standard of living and higher individual contributions to social security and taxes in general.

- Manufacturing adds depth to the economy and improves the overall mix, including providing local markets for other industries and services, and thus economic resilience.

- Manufacturing may be particularly important in the event of an armed conflict that restricts critical trade in essential supplies and weapons.

- Traditionally, manufacturing jobs are perceived to provide a wide range of employment opportunities for workers ranging from recent migrants with poor English to engineers and scientists at the leading edge in technology. At its best, manufacturing can deliver a sense of pride in achievement and fulfilment to its workers.

Government assists and impacts manufacturing through regulation, planning, infrastructure, education and training, law and order, the value of the dollar and so on; but there is no longer any appetite for government to be drawn in to active participation in manufacturing activity, either through government owned enterprise or as an equity partner.

Nor is there any prospect for the protection of manufacturing through trade preference or tariff protection. Indeed such measures are generally prohibited by various free trade agreements (particularly with the USA) Australia has made. An exception is the limited local purchasing preference exercised by various State and Local governments.

But in recent times there have been two surprising changes in this perception. The first is the preparedness of governments overseas to socialise the losses of various banking institutions. This suggests that if a private company is big enough, or politically sensitive enough, democratic governments may become electorally committed to their survival. This is reflected in past, and even recent, business ‘rescues’ within regional Australia.

The second is the economic argument and justification for a carbon tax (or equivalent restrictions like 'cap-and-trade arrangements' on carbon production) based on the observation that carbon dioxide is an economic externality (or spill-over: an impact on a party that is not directly involved in an economic transaction). In this case the impact is a perceived threats to World climate; the ecosystem; and the future of agriculture.

Producers of carbon dioxide such as: car drivers; public transport users; households; and other consumers of industrial products; are not paying a price that reflects the full cost of that production. A tax (or cap on production) is thus economically justified to change private costs to resemble public costs and thus bring consumption costs into a more equitable equilibrium with real production costs (or vice verse).

It has been equally be argued that mineral exploiters are not paying a price that reflects the real value of those minerals to future generations and thus should be paying a like tax or be capped. A similar argument may pertain to soil and water or world forests.

Applying a mining tax has, a presently very small, penalising affect on Australia’s balance of trade. Such a tax will depress the value of the dollar relative to competitors currencies; implicitly diverting more economic resources to manufacturing; and other non-mining sectors; than would otherwise have been the case.

If the effect of a carbon tax or cap was to penalise coal exports, relative to other minerals originating in other states, one economic impact may be to accelerate their relative rates of exploitation; and NSW may well believe that it was inequitably dealt with.

It is often asked if the present free trade settings are prudent, given possible geo-political economic instabilities and uncertainties. But the issue then becomes how to decide on an intervention that would increase rather than damage future resilience; particularly as Australia’s current economic strategy may have, to date, led to a better outcome from the Global Financial Crisis than that of almost every other developed economy.

Because ‘industry’ protection ultimately resolves to encouraging some firm ‘to tool-up’ to produce a particular productlike an outmoded automatic transmission; a soon to be superseded weapon; or 35 mm film stock; a successful outcome requires a long term commitment to a particular company, or group of companies, and their ongoing product range. This level of involvement in commercial enterprise is very difficult for government to justify or sustain in the medium or longer term.

Government is notorious for selecting inappropriate product manufacturing to protect like lead-acid car battery manufacture or vinyl record pressing. It is almost impossible to decide what products will be ‘strategic’ in twenty years time. As a result governments find it 'safer' to support established, even dying, industries; and there are no votes in yet to be formed businesses.

When governments in Australia built trains and telephones; owned banks and airlines; protected car makers and clothing manufactures; and engaged in a myriad of other commercial interventions; they failed to provide similar support for the computer; microelectronics or advanced materials industries that now account for so much of the world’s newer manufactured products.

Under the free trade floating currency economic settings there is no ‘fortress Australia’. Australia does not need to (and cannot) do everything. There is no role for government in deciding we need to make this or that (typewriters, dial telephones, CRT televisions or computer monitors, video tape etc) even for infant industry or ‘strategic’ reasons.

The only exception, on defence grounds, is the sourcing of military equipment; an area fraught with cost overruns, technical shortcomings and often charged with apparent administrative incompetence (not exclusively Australian).

Under our current settings the decision to make something is a commercial decision made by business people and their employees, who lose their money and/or their jobs if the enterprise fails and make a nice profit and income if they are successful. In this context they cannot, or must not be allowed to, turn to government if they fail; to ‘bail them out’ to ‘privatise the profits and socialise their losses’.

These settings encourage Australians to be quick to exploit market changes and to demand (and give) value for money. Wealth is maximised by having a working population that is better able to contribute to the wealth creation process than competitor countries. This is optimised by a workforce that is multi talented and exceptionally knowledgeable, experienced and skilled in their chosen field.

Wealth is further optimised by not tying down these productive resources in the wrong kind of business or in the wrong locations on historical grounds. Unless manufacturing (or any) businesses retain their competitive advantage (or can be expected to rapidly regain it after a short setback – for example due to drought, war, or some other disaster) they need to close. Such closures need to be swift and their employees need to be assisted to find new productive businesses to work in; on occasion in another town or State.

The economic role of government in this economic paradigm is to provide the necessary externalities to the business including a social, educational and research environment in which appropriate skills and experience can flourish; to ensure that the physical infrastructure adequately supports commerce and to ensure that Government owned trading enterprises are properly and efficiently run in a competitively neutral way.

But as its ultimate aim is to optimise the standard of living of Australians, government also has a duty to support non-oppressive law and order; a healthy environment and lifestyle; as well as encouraging cultural and intellectual freedom of opinion and debate and these, sometimes competing demands, need to be balanced appropriately.

It's a developing world

As the recent, and in some places still current, Global Financial Crisis has demonstrated the growth businesses in India and China are closely tied to Australia’s success; the more competitive they are the better off we are.

Following the assumptions set out at the top of this paper Australia is now committed to free trade and its benefits. These principles deliberately disregard longer term strategic thinking (for example about future industrial capability for defence or other strategic specialisation like longer term skills development) in favour of maximising immediate national wealth by buying international goods and services at the best price available and selling our internationally traded goods and services at the best price we can get.

Disregarding capital flows the size of the total trade ‘cake’ is set by how much international markets want to take of our products and services and how much we can deliver at a price they are prepared to pay. It is an economic tautology that under a floating currency, Australia’s exports (visible and invisible) balance our imports (after adjusting for the balance of inward and outward borrowings - investment flows). It inevitably follows that consuming more international goods lowers the value of the $A, and makes our exports more competitive. Correspondingly the success of our exporters (or some exporters) raises the traded value of the $A, and makes other exports less competitive.

Our exporters are competing with each other for a place in the export mix. They are not competing (on price) with overseas producers of similar goods but with other Australian exporters for a piece of the available export action. Thus (investment flows remaining constant) if services, minerals, grains or other manufactures get a bigger share of the ‘cake’, some marginal manufactured goods become less competitive. If imports increase without a corresponding increase in exports, the dollar will fall making some imported goods more expensive and some exported goods more profitable to manufacture locally.

Overseas manufactured goods are only ‘cheap’ because some of our exports are excellent value for money in international markets (at current currency equilibrium values). Manufactures who wish to stay in business need to make products that are at least as good ‘value for money’ as the products of our other exporters (alumina, LNG, iron ore, coal, wheat, wool, wine, as well as mining and medical machinery, therapeutic drugs and so on).

Of course capital flows also affect the value of the dollar. Higher capital inflows raise the value of the dollar and make local manufacturing less competitive. Higher returns encourage more foreign investment. In part returns are determined by interest rates; in turn influenced by the level of economic activity; and any resource misallocation (for example of labour or capital) or shortfall (eg over-full employment) that leads to inflation.

Current projections by the minerals sector suggest a substantial escalation to meet the increasing raw materials demand particularly of India and China but of developing countries generally. Unless imports increase substantially, it can be expected that this increase in mineral exports together with any resource shortfalls (eg in labour) will make some local manufacturing less competitive. To offset the need for more labour Australian businesses are likely to increase automation and seek more economies of scale.

Manufacturers that continue to trade will need to introduce new equipment and methods as they compete for skills with large minerals developments. While a proportion of the increase in plant and equipment needed by all players will be locally sourced it is probable that much will be sought on world markets and a proportion will come from India, China and other developing countries as well as from North America, Japan and Europe. These imports will place some offsetting downward pressure on the dollar.

If the present minerals sector expansion projections are correct, the degree to which the finance for such projects comes from overseas, together with any additional share in the export ‘cake’, will determine the net upward pressure on the dollar that will result. In turn, this will determine how much more competitive imported goods from the developing world are about to become and ultimately the degree to which Australian industry becomes more capital intensive and labour productivity is thus increased.

The outcome is likely to be the increased importation of mass produced goods that benefit from economies of scale (as do our mineral and some agricultural exports). Export exposed local firms are unlikely to be able to compete in these market sectors and will need to find new innovative high value or up-market products or a means of adding value to imported components (eg assembling imported components; using their established distribution chain; marketing; product design; or branding).

The products India, China, Taiwan, Malaysia, Singapore and Korea successfully export to Australia include: cars and trucks; electronic devices; wind turbines; railway carriages; industrial machinery; white goods; small domestic appliances; and a wide range of textiles and clothing. These are often designed in developed countries and branded as European or US products. Those successfully exported by Australia are often custom installations or small run manufactured equipment like specialist medical and scientific equipment, mining and other machinery (often with a high design component); products protected by patent, registered design or copyright; or products adding value to food, minerals or other primary products.

Additional capital intensiveness requires investment. This can be provided internally from revenue, borrowed (via the financial network) or by attracting additional equity investment. While encouraging more international equity investment into Australia makes our exports less competitive, this can be justified if it brings with it new technology that provides new products appropriate to Australian manufacture or improves productivity and total wealth (making the cake bigger rather than sharing it differently).

To support their development several developing and developed countries keep their currency well below its underlying market value. While this denies their citizens lower cost imports and luxuries (and makes international tourism a luxury; and visiting Australia less attractive), it makes their exports more competitive internationally and local manufacturing more profitable. It also results in an accumulation of foreign currency reserves that are effectively accessible by others, through the banking system, as loans for investment.

Developing countries often apply this mechanism as the higher work for less real income imposed on a domestic labour force can be hidden in (and is justified by) an environment of rapidly improving living standards. China is the prime example in the World today. As a result there is an ongoing exchange between the US and China as to how long this can go on; with China now challenging Japan as the principle source of US foreign investment; and the Chinese remarking unfavourably on the current US deficit and fiscal policies that undermine their $US investments.

India, and several other developing countries, also manipulate their currency to stimulate development; with varying degrees of success.

Under this world view, the goods and services demand and competition coming from rapidly developing economies like China, Taiwan, Korea and India, as well as from Japan, the US and Europe, are expected to benefit Australians by providing advanced products and competitive prices; at the same time encouraging Australian manufactures to be innovative, to use the latest equipment, processes and techniques and to compete in those areas where they can best contribute.