2 July 2012

I’ve been following the debate on the Carbon Tax on this site since it began (try putting 'carbon' into the search box).

Now the tax is in place and soon its impact on our economy will become apparent.

There are two technical aims:

- to reduce the energy intensiveness of Australian businesses and households;

- to encourage the introduction of technology that is less carbon intensive.

These are confused by a plethora of subsidiary aims including:

- retaining government in the past by forming a coalition with the Greens ;

- attempting to retain government in the future by over-compensating low income households;

- being enabled to take the moral high-ground in international forums where climate change is debated;

- raising public awareness.

The technical changes are intended to make a contribution to lowering the world’s overall carbon intensiveness and hence the release of greenhouse gasses; principally carbon dioxide (CO2) and methane (CH4).

There are several papers already on this site covering these issues. The one on the Greenhouse Effect was first written over 20 years ago; and apart from the firming up of some of the supporting science it stands today unchanged (read here).

I do not dispute that the exponential increase in the human release of these gasses, along with agriculture and ocean and other pollution, overloads the natural mechanisms for their absorption; the Carbon Cycle. This poses a plausible threat to the climate that may be sufficiently extreme to compromise our present well-being.

But I have questioned the practicality and efficacy of the Australian Carbon Tax as a means of addressing this threat.

Let’s look at these two principal goals

As all goods and services encapsulate energy it's obvious that high income, high consuming, families consume more energy per capita than low income families.

But it is by no means intuitive that high income families consume more electricity in the home. High income families typically consume a higher proportion of income on services than goods and the cost of domestic energy is relatively less significant. These families, particularly those with two incomes, spend a smaller proportion of their time at home than a pensioner or single income family. Nor is it obvious that they habitually watch more TV or run more electrical appliances. Even the Federal Government suggests the impact of the Tax on the behaviour of high income families is expected to be minimal.

On the other hand, overcompensation of low income families means that they could actually elect to increase their energy intensiveness. The compensation seems to send the opposite message to the one intended.

Nevertheless the general rise in energy costs, above the general cost of living, does impact overall demand; because its price, relative to other goods and services, determines consumer choice.

So if the Carbon Tax increases the cost of domestic energy in isolation, it will achieve a lowering of consumer demand for domestic energy. Thus low income families may elect to spend their windfall on food, clothes or housing; rather than on maintaining their present levels of electricity consumption.

But the main impact of the Tax is on business. It is levied on a Government selected group of so called ‘big polluters’. These businesses, including some Local Governments, either have no options for reducing carbon intensiveness or need to make substantial readjustments to their business model and investment. Businesses are faced with handing on the additional costs to their customers; and those customers to theirs and so on; until it reaches the consumer’s shopping basket.

The resulting price increases may well reduce the demand for their goods and in some cases may result in the business no longer being viable.

To avoid high profile closures the Federal Government is giving back 40% of the tax to a number of trade exposed businesses; including Steel and Aluminium manufactures; and brown coal electricity generators, the most polluting of all.

It is hoped that by these means the second and longer term goal will be achieved; the introduction of technology that is less carbon intensive.

Will it succeed?

I have previously argued that the present Tax is a bad way of going about this. It is in serious breach of the founding principles set out in the Government’s own ‘Henry Tax Review’:

| All taxes need to be simple with clear guidelines and a minimum of exceptions or exemptions. For example under no circumstance should an entity (a person or a business) be taxed and then be compensated for the taxation impost. link |

Not only does this tax involve compensation to those taxed; the arbitrary nature of both those chosen to be taxed and those compensated; borders on outrageous. Why is one big 'polluter' any worse than a dozen small ones, collectively of the same size? Why is a brown coal plant compensated when a less polluting black coal one is not? The previously proposed cap-and-trade scheme at least provided the potential for an across-the-board solution with less economic distortion (read more).

As discussed elsewhere on this website, the greatest environmental policy impact on the electricity price remains the Government's renewable energy targets. This impact is twofold:

- through the implicit cost of subsidising large scale renewable energy power stations, principally Wind Power and PV Solar;

- and the cost of reorganising the electricity distribution, the grid, to accommodate these facilities and related changes in the concentration of electricity generation.

But while they have already slowed the increase in electricity consumption these policies do virtually nothing about Australia’s contribution to present human disruption of the natural Carbon Cycle.

Australian carbon consumption per capita is very high but our population is 0.3% of the world total. The reasons for our high carbon intensity are our high living standards and great transport distances; combined with the ready availability of domestic coal and gas; and the scarcity or high price of alternative energy resources.

In most of the world hydroelectricity is a significant contributor; and in most developed nations nuclear power makes a contribution. Some geologically active countries gain a small input from geothermal power and some have good wind or solar resources close to population centres.

The potential of alternative energy resources is discussed in some detail elsewhere on this site. But these are so insignificant in Australia as to be irrelevant to our actual impact on the Planet.

Australia's Global Impact

Our major impacts on the Planet are: the impact of agriculture; and the impact of mining.

Australia represents about 5% of the total land area of the Planet. Agriculture is both a carbon sink and a carbon emitter. Most agricultural production is consumed overseas representing embodied carbon exports; while we import (mainly processed) food; that represents embodied carbon imports. The transport distances involved are amongst the longest in the world. Transport is very carbon intensive.

Australian broad-acre agriculture represents a significant transformation of natural land and water use and has a far greater impact on the world climate than Australian secondary industry.

Australia is a major coal, gas and mineral exporter. Far more fossil fuel is exported that that consumed domestically. In addition most minerals are exported as ore that needs very energy intensive energy processing to convert it to useful materials. Principal among these are the ores of iron and aluminium but there are numerous other minerals that are even more energy consumptive.

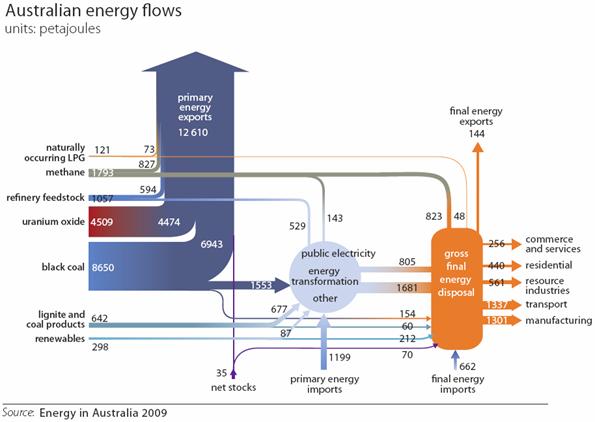

Although we are individually large carbon consumers, our domestic consumption of fossil fuels is less than 20% of our total energy exports. Over 80% of our impact happens overseas.

Not all of these exports are carbon. On the positive side around a third of our energy exported is represented by uranium oxide. This is consumed overseas and replaces carbon. A small increase in uranium oxide exports would do more for the global environment than, apparently politically targeted, fiddling with industry costs.

The focus of the new tax on selected 'carbon polluters', while we continue to increase mineral and agricultural exports unabated, is a case of ‘fiddling while Rome burns’.

The World Economy

At the present time much of the World is facing hard economic times and unemployment rates are at historically high levels. Much of the ‘first world’s’ economic growth has stalled. Energy consumption has fallen away and this is partly masking the world's greatest driver of increasing energy demand.

In countries that combine capitalistic economic policies; socialist wealth re-distribution; and a ready pool of domestic consumers who do not yet enjoy first world patterns of consumption, rapid economic growth is sustainable in the face of ‘first world’ recession.

Principal among these self driven economies is China; already the World’s third largest economy. Others in SE Asia, like Vietnam, and some areas of India and South America are emulating this pattern. As a result Australia’s exports to these countries have been little affected by conditions in Europe and North America; and our domestic investment, particularly in the export sectors continues at record levels.

But this is a two-edged sword.

The environmental impact of well over two billion people increasing their energy intensiveness to first world standards with the corresponding increase the consumption of fossil fuels, as well as their impact on agriculture and mining is difficult to comprehend. This is likely to increase the global impacts of some of these industries a hundredfold in a few decades.

As first world economies recover these trends will again become starkly evident.

These energy demands have the same root cause. At seven billion there are far too many people on the planet; and all of us want to consume energy and material goods. While endeavours to reduce fertility seem to be succeeding in many countries, unless there is some serious disaster that reduces world population, our numbers are still bound to rise to at least ten billion; as people already alive live longer. Of course, one such disaster might be global warming (read more).

I, like you, am here because of the population boom that preceded my birth. Carbon based fuels provide by far the greatest proportion of the energy that has enabled this population explosion.

So it would be hypocritical to regret those technological advances that replaced human and animal labour with machines; gave us new materials, modern communications and means of travel; recreation and entertainment; and created the modern economy.

But we were all born addicted to carbon. While we may be able to substitute renewables for some fossil energy; we need modern materials too. Carbon consumption is now essential to sustain us. Global consumption growth will continue; driven by improving living standards and population growth.

We may be able to slow this growth by raising its relative price but ultimately, like gold, we are likely to dig up and consume all we can find and get access to.

The present tax will have little or no impact on this. Globally it is little more than ‘spitting into the wind’.