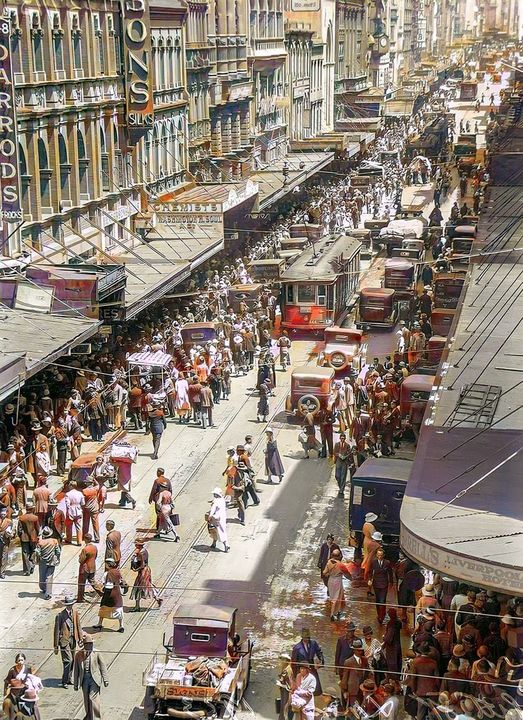

When I first saw this colourized image of Christmas Shopping in Pitt St in Sydney in December 1935, on Facebook (source: History of Australia Resources).

I was surprised. Conventional history has it that this was in the middle of the Great Depression. Yet the people look well-dressed (perhaps over-dressed - it is mid-summer) and prosperous. Mad dogs and Englishmen?

So, I did a bit of research.

It turns out that they spent a lot more of their income on clothes than we do (see below).

My historical bible for economic events in Australia is the Australian Commonwealth Year Book. They can be read on line at ABS - Statistics by release date.

The 1938 edition informs me that unemployment began to rise in December 1929 (to 13.1%), after the Great Crash on Wall Street in New York in October that year.

At the peak of the World-wide Depression, in June 1932, Australian unemployment reached 30%.

Rural Australia had already been hit by a series of droughts through the 1920’s and was just recovering when the worldwide economic collapse occurred. More swagmen resulted but few were jolly.

By December 1935 unemployment had fallen back to 13.7%.

Unemployment then fell steadily, to below 10%, until September 1939, when World War 2 broke out and a new paradigm began, as many were provided with free overseas travel opportunities.

The unemployment rates were averages across the country. Some industries, towns and regions were worse hit, while others did somewhat better.

In Sydney, large infrastructure projects like the Sydney Harbour Bridge and associated underground stations and tunnels, along with the: ‘fast electric trains’ and the expansion of the tram network (sound familiar), were funded by long term loans from London banks, and provided work throughout the Depression. By the way, the colourizing is incorrect: the trains were red but the trams were green.

In December 1935 the average adult male wage, for an average 45-hour week, was 82 shillings and 10 pence (£4/2/10 or $8.28). The adult female average weekly wage was just 45 shillings (£2/5/- or $4.50). Two weeks annual leave was the norm and some workers got public holidays only.

This difference between male and female rates of pay enjoyed wide social support, because after marriage, most women were required to resign and were thus prohibited from earning a wage. Boys were also paid far less than men. Unmarried men were viewed with suspicion.

Today, most families have two incomes and the average female wage is 82.5% of the male wage. Hours worked are considerably less and four weeks annual leave is the norm.

Many things were a lot more expensive in the 1930’s like: overseas travel (many months wages); an overseas phone call; or a simple radio (that cost at least a month’s wages). Other goods and services, that we now take for granted, were not yet invented or were beyond the reach of an average household.

The Year Book Australia 1938 (Page 543) provides some insights:

In the 1930’s households spent almost 35% of their income on food. We now spend less than half that. An even bigger change is in clothing and footwear: in the 30’s they spent 20% of household income on clothing we now spend 3.6%. Surprisingly, they also spent more of their income on domestic fuel and lighting (5.5% compared to 2.6% today). And they didn’t even have television.

The savings we have made on food, clothing and accommodation we now spend on private transport, recreation, miscellaneous services, health, communication, education and personal care.

These were largely the preserve of the wealthy in the 1930’s. For example, average families did not own a car.

But what about houses? Average Australians now spend around 20% of household income on housing. In the 1930’s households spent 24%. Yet, paradoxically, many of the exact same houses, are far less affordable now than back when they were newer.

Here are a couple of sale advertisements from the Sydney Morning Herald:

- North Sydney (brick cottage, Milner - crescent, Wollstonecraft) £1450;

- Cremorne (detached double-fronted brick cottage, Gerard-street) £1050

This was 4 to 5 times the average annual household income (male annual wage).

These same houses now sell for over 20 times the average annual household income (for a working couple).

OK, so Cremorne and Wollstonecraft are expensive suburbs, but they were just as nice back then (actually Gerard Street Cremorne is a lot less nice – the developers have been at work – have a look on Google street-view).

****

While browsing the yearbook I also came across this:

“At the Melbourne University the Commonwealth Government maintains an X-ray and Radium Laboratory for the purposes of maintenance of the radium and radium apparatus, the production of radon for treatment and research purposes, and the investigation of physical problems of X-ray and radium therapy and protection measures.

During the year 1937 a total of 37,077 millicuries of radon were issued by this laboratory and used in the treatment of cancer and in the prosecution of research. Radon Laboratories have been established also at the Universities in New South Wales, Queensland, South Australia and Tasmania. Local physical services in relation to the use of radium and X-rays in treatment have also been established, based on the University in each State and all working in co-ordination with the Commonwealth X-ray and Radium Laboratory.”

This was in the early days of Radium Beam Therapy against cancers, pioneered in Britain in 1933. It was the forerunner of the treatment I had around this time in 2021.

Radon gas was widely used in the US, as alternative to surgery, to remove tonsils and other unwanted organs. This worked but resulted in radiation related cancers, later in life, for a proportion of the patients treated.

The year book is also interesting for similar examples of the infamous: 'Melbourne bias' among the Federal Public Service.

In 1938 almost all Commonwealth Public Servants were based in Melbourne. They were not moved to Canberra, until the Menzies Prime Ministership, after the War, each Department, in turn, 'kicking and screaming' against the move.

Canberra, in the middle of nowhere, was nothing like relatively cosmopolitan Melbourne.

Sydneysiders continue to notice this Melbourne bias in ‘Your ABC’; even more evident during the recent pandemic, that was never fully moved to the capital nor fully diversified to the largest city.

****

Immediately following that section, I noticed this:

Ҥ 9. -Medical Inspection of School Children.

1. General. - Medical inspection of school children is carried out in all the States.

Periodical and/or regular investigations are carried out into problems affecting the health of children, such as goitre, crippling, mental deficiency, stammering, left-handedness, nutrition, trachoma, acute rheumatism; and special investigations into outbreaks of infectious diseases occurring in schools.”

It appears that left-handedness was a considered a serious handicap. No wonder I was forced to write with my right.

Fascinating reading.