Markets

There were no Cucumbers in the market this morning sir, I went down twice.

No Cucumbers!

No Sir. Not even for ready money[50].

Markets are one of the things that distinguish human society. Like genes and the ideas we receive, markets have a great influence on our lives; how we will earn our living, how wealthy we will be, where we will live and what we will do.

Co-operation for survival between animals and plants and the process of natural selection (for genes and memes) are very like the interplay of market forces. This is because the forces that govern both markets and the success of plants and animals are an outcome of individual specialisation.

Like the processes of natural selection, markets do not automatically or necessarily act in our best interests.

Our word 'market' comes from the idea of a trading place (perhaps a town square) where people take produce to sell and others go to buy what they want. In some primitive societies markets might be restricted to swapping fruit for some meat or food for clothing but as soon as we specialise in producing fruit or meat this doesn't work.

If I grow cucumbers and you produce wool it is unlikely I would give you cucumbers in return for wool; I probably want clothes not wool. So we need something we all agree is valuable; that I can get in return for cucumbers and you can get in return for wool. I can use it to buy clothes and you can use it to buy food (or whatever else we need).

We call this 'means of exchange' money. Means of exchange have been invented in some form by every society that has evolved specialisation. It might be metal tokens issued by the government or promises to pay if called upon (like checks or bank notes). It might be shells or beads or gold bars or salt. In the early days of NSW it was rum.

Yet money, in some form, remains at the heart of all economies in which people specialise as tinkers; tailors; soldiers; or cucumber growers. It has been shown that even monkeys in captivity can learn to use money (and spontaneously exchange it for sexual favours).

But how do we know how much money you ought to get for a bail of wool and how much should I get for a cucumber?

Well, the marketplace will do it for me. If I take my load of cucumbers to the market and lots of people want my cucumbers (or people want lots of my cucumbers) the ones who want them the most will offer more than the others and I will get a good price.

But if lots of other cucumber producers turn up at the same time we all might have to lower our price; so that even people who might have come for carrots think cucumbers are a bargain and buy them instead.

If we cucumber growers get good prices we will decide to grow more. As we do it will eventually cost more for each extra load we try to produce (cucumber producing frames will be harder to get or position) and more cucumbers in the market will lower the price. Some cucumber growers will then decide to grow something else. If we grow less we may get a good price per item at the market; but too high a price will discourage people from buying cucumbers and will encourage others to start growing cucumbers.

So there is a price and quantity in the marketplace at which we growers get enough money to make it worthwhile growing cucumbers and they remain cheap enough for people to want to buy all we produce. Each grower decides how many to grow by looking at the price they get and how much time and money it costs to grow cucumbers. Buyers look at the price to decide how many they will buy. When the buyer's price and quantity match the grower's price and quantity everyone is happy. This is called supply and demand equilibrium.

This is very like the way plants and animals compete for resources and comparative advantage that decides their number and variety.

For this to happen everyone needs to know the prices being set and everyone must be allowed to buy or supply the goods or services in demand. People and resources must be free to move in and out of the market. Changes must not be too fast for producers and buyers to react to and there must be no restrictions on producing anything (or trade secrets about how to do it). If an area of country is discovered to have an advantage for production, people must be free and willing to move there.

If they worked like this, markets would ensure that we don't produce more than people want (at a particular price) or charge too much or too little for what is produced. Carrot and wool producers; all producers; would get the price for their product that reflects the value consumers attach to their product and nothing is overproduced or overpriced. People would move to the best places to do things. Natural resources would determine the size of the population and every community will have the same average wealth; the only way to be richer than average would be to work harder or to be smarter.

In this environment no one would make high profits for very long because others would immediately start competing. The general price of things would be set by the general standard of living that people expected for the amount of effort they were prepared to put in.

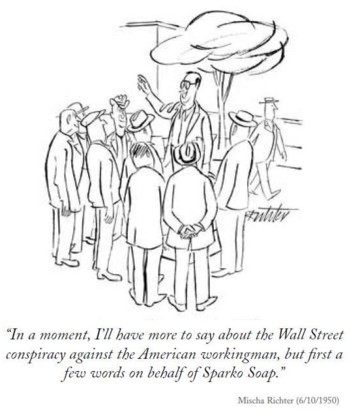

In reality markets seldom work like this. As Pareto found, some people are much wealthier than others who work just as hard and are just as smart. As you will find out, many wealthy people don't work much at all and quite a few are stupid. They often achieve their initial advantage by preventing markets setting a proper price for their work[51]. Ways of doing this include clubbing together to keep others out, keeping production knowledge secret, controlling access to essential inputs (including capital) or by controlling who can buy or sell.

Doctors, lawyers, stockbrokers, cab drivers, chemists and newsagents all try to prevent too many others joining their ranks. Unions try to set labour costs, manufacturers protect their products with patents; artists protect their ideas with copyright. Media moguls try to limit the number, scope and ownership of spectrum licences, others try to form monopolies or cartels and communities shut their borders to immigrants.

Real life markets are complex; like the interplay of organisms in nature. They encourage innovation like new species evolving to fill new niches and co-operation like the cells in our bodies. But they are not always in our best interest. The wolf on the fold, a fox amongst the chickens, the cuckoo in the nest, plagues of locusts and cane toads all have their equivalents in our marketplaces. Markets can foster waste and addiction (how many computers or mobile phones are dumped? how many cigarettes or amphetamines are consumed?). They reward short-term advantage and accidental success. We are human and our markets are also breeding grounds for fashion, ideas and self-imposed rules.

In the end, the value of money is equivalent to what people are prepared to do for it. All human exchanges can be seen as the interplay of market forces. Markets in various forms are central to the study of Economics. But there are several Economic schools of thought ranging from highly mathematical to cultural. At one end of this spectrum are those who believe that provided the money supply is set correctly markets can be relied upon to do the rest. At the other end that this only ensures 'the rich get rich and the poor get poorer' (In the meantime in between time; ain't we got fun[52]).

There are many complex factors at work and the way we organise markets is also fundamental to politics. John Maynard Keynes British economist (1883–1946) famously wrote:

The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back[53].

Markets themselves are an idea; a human idea. Some people conceive of a perfect marketplace in which competition is the only mechanism that needs to be preserved in order for all else to fall into place. Others (like John Maynard Keynes) point out that market equilibrium, based on perfect competition, guarantees neither full employment (job for everyone who wants to work) nor social equity. Indeed because markets are dynamic, due to all sorts of external impacts ranging from climate and technology change to fashion and expectations (human ideas), market equilibrium is never achieved.

Again we see these things in a fundamentally human way; determined by the ideas that together define us, and the world we live in.

As Michel Foucault, the French philosopher (I have already mentioned) observes:

There are more ideas on earth than intellectuals imagine... Ideas do not rule the world. But it is because the world has ideas ... that it is not passively ruled by those who are its leaders or those who would like to teach it, once and for all, what it must think.[54]

Today we have markets for everything from houses, clothing, and food to collectibles (stamps, jewellery or paintings) and ideas. We have markets for money and for the future price of things that don't exist yet. Instead of a market in the local town to which the locals brings their produce, we have the global marketplace. We now market many things (including bull semen, electricity and shares) by the Internet. The price of everything is measured against the price of everything else.

Indeed cultural economists point out that we don't really know the value of anything in isolation from that of other things or our culture. What is the real utility of a mobile phone? I once got on quite well without a phone at all. Why am I prepared to pay what I do for it? Do I really get the same utility as you? Why do I prefer this house over that? Has my utility really risen with property values? Why do my buying behaviour and price expectations change? Why do advertisements increase sales, even for well known and traditional products like beer and cars?

Often government makes laws or takes action that interferes in markets. This is not just because of powerful lobby groups. Some economists and political scientists believe that intervening in markets, for the benefit of society, is the central role of government.

These days we have money that can't be found on the beach - although rare minerals on a beach can be very valuable. Our money supply is now largely virtual with only a small fraction in the form of tokens (coins) or notes with promises to pay (bank notes). And it's volume is carefully regulated, institutionally, to match market requirements. Too much supply and the currency loses too much of its value (excessive inflation); insufficient and the marketplace (the economy) will be hampered and unemployment, of people and resources, will rise.

I'm simplifying, because Central Banking becomes much more complicated than just regulating the amount of money being created by the lending banks, regulators also need to take into account external trade; investment; capital flows; borrowing; Government fiscal policies; and such externalities as drought; floods; other disasters (current and projected); and foreign relations.

Just as weeds take resources from useful plants in an untended garden, and weeding thus increases productivity, so society works better when markets are regulated. Health is far better today than before public hospitals; indeed modern medical science has its roots in public health. Public education is the driving force behind every advanced nation. The community best funds many public works. Innovation works best under patent and copyright protection.

Unregulated land development degrades cities and the environment and diminishes the quality of life. Private police or security guards do not best keep law and order. A gang of vigilantes would not best administer the courts. The right to exploit resources is not best established by who has the most powerful private army. The list goes on.

Governments are under constant pressure to increase regulation in some areas; to get tougher on people with no respect for property ownership (a form of market regulation) or to protect the environment (by limiting market forces leading to exploitation) but to remove regulation in others. Most advanced societies balance demand for more regulation with demands for deregulation. Getting the best social outcomes from the resources available has been defined as the fundamental role of Economics.

As our understanding of the Universe has expanded, and with it the effectiveness of technology, machines have progressively replaced muscle power. Slaves servants and working animals have been supplanted by motors and the mechanisms and machines that they drive.

Almost all material goods are mined; grown; processed; and/or manufactured by machines. Electronic devices, that can be programmed once and then repeat a task indefinitely; and make increasingly elaborate decisions themselves; are increasingly replacing human intelligence too.

Some describe this as the post-industrial economy where goods are plentiful and inexpensive and where some classes of good become cheaper as the volume increases; so that higher demand lowers the production cost, and potentially, the price.

Such an economy is no longer constrained by scarcity; the cost of production; or the 'sweat of the workers' but by consumer demand. A contemporary remedy for declining growth is to put unearned money into the hands of the most avid consumers. This can be as crude as a cheque in the mail or might be achieved by a combination of quantitative easing and increased social benefits.

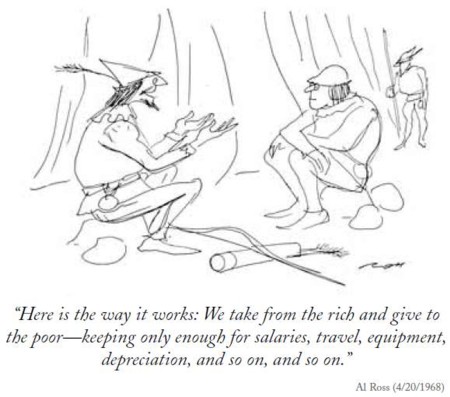

Thus social security programs based on the Communist (Marxist) conception 'From each according to his ability, to each according to his needs'; or the simple humanist, egalitarian principal that every child should be given the means to reach his or her potential; are supplanted by the principal that everyone should be given sufficient means to consume hamburgers, the latest fashion in clothes, time at the gym, holidays and popular music. As wealth increases, and basic material needs are met, consumption patterns in these markets move in the direction of services, fashions, entertainment and recreation.

Taxation and wealth redistribution by government have become fundamental to the development of the post industrial societies. State interventions in the operations of the many markets involved; together with the laws and regulations established and enforced; defines effective government. Efficient effective taxation is central to this success; for example governments should avoid excessive complexity or taxing the same person that they are providing the benefit to (tax someone and then give it back - after deducting administrative costs).

Just as wealth is not evenly spread between individuals, people in some countries are wealthier than in others where people work just as hard and are individually just as smart. The success of a State in supporting the wealth of its members is dependent on the institutions (particularly its government) the community has evolved and how these intervene in its markets. Success is the mark of a successful culture.