Thomas Carlyle coined this epithet in 1839 while criticising Malthus, who warned of what subsequently happened, exploding population.

According to Carlyle his economic theories: "are indeed sufficiently mournful. Dreary, stolid, dismal, without hope for this world or the next" and in 1894 he described economics as: 'quite abject and distressing... dismal science... led by the sacred cause of Black Emancipation.' The label has stuck ever since.

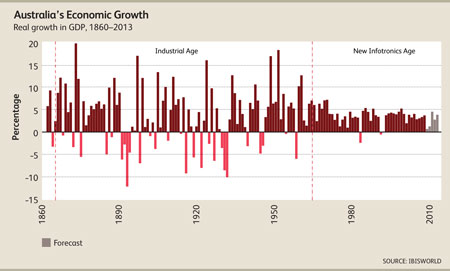

This 'dismal' reputation has not been helped by repeated economic recessions and a Great Depression, together with continuously erroneous forecasts and contradictory solutions fuelled by opposing theories.

This article reviews some of those competing paradigms and their effect on the economic progress of Australia.

In Australia economic thought took a couple of U-turns last century

For its first one hundred and seventy years the economy of New South Wales (and then Australia as a whole after 1901) was extraordinarily vulnerable to climate and agricultural trade cycles.

Phil Ruthven IBIS: ‘The chart shows Australia’s economic progress over 140 years... ‘The volatility was enormous both before and during the Industrial Age (1865-1964) largely due to weather. Agriculture remained over 15% of our GDP for most of that period… ‘a 25% fall or more in output would slice 4% off the economy by itself - with a domino effect through the food & fibre input-output chain - causing a recession. We had 27 such years or one every 3-4 years...

During the 20th century Australian governments experimented with the full spectrum of government interventions to develop manufacturing; both to reduce our dependency on agriculture and to increase Australia’s military resilience. To grow and protect manufacturing Australia applied, then abandoned: selective tariffs; publicly owned businesses; and enforced government purchasing preferences.

Until the start of the 20thcentury the political differences in pre-federation Australia were polarised around the issue of ‘free trade’ verses protection (NSW versus Victoria).

The electoral success of the Australian Labor Party (in 1910) (following the Marxist social analysis in the mid 19thcentury, and English Fabianism) led to a new polarisation around worker’s rights and the socialist alternative to capitalism; retaining a strong protectionist sentiment. With the split in the Labor party, at the start of the ‘Great Depression’, a new ‘United Australia Party’ (in government from 1932 to 1941) formed around ex Labor Treasurer Lyons and Labor splinter groups, together with the older establishment dominated parties (both free traders and protectionists).

Thus by the middle of the century, both major parties had elements combining the older protectionist movements, as well as elements supporting socialism and public ownership. Protection and government owned enterprise became an accepted reality on both sides of politics, reinforced by industrial mobilisation during two world wars.

By the mid 1960’s, under the protection of import tariffs and direct government involvement in economic production, manufacturing in Australia had grown to become the largest and most productive sector in the economy, long supplanting agriculture, services and mining.

But as the Menzies/ McEwen era drew to an end in the late 1960’s it was already apparent that much of this manufacturing and government enterprise was inefficient and unable to compete internationally. Within the new Universities, post-war academic sentiment was swinging towards Neo-Keynesian (eg Samuelson) or Monetarist (eg Friedman) economics together with a strong belief that freer markets would deliver greater economic efficiency and administrative simplicity. The intellectual climate had changed.

Free trade and free market arguments prevailed, in both major political parties, and the progressive withdrawal of protection followed, along with the disposal of government owned businesses and local buying requirements.